Life Insurance in and around Corryton

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

People purchase life insurance for various reasons, but the primary reason is always the same: to ensure the financial future for the ones you hold dear after your passing.

Get insured for what matters to you

Life happens. Don't wait.

Agent Devin Masoner, At Your Service

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Devin Masoner is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

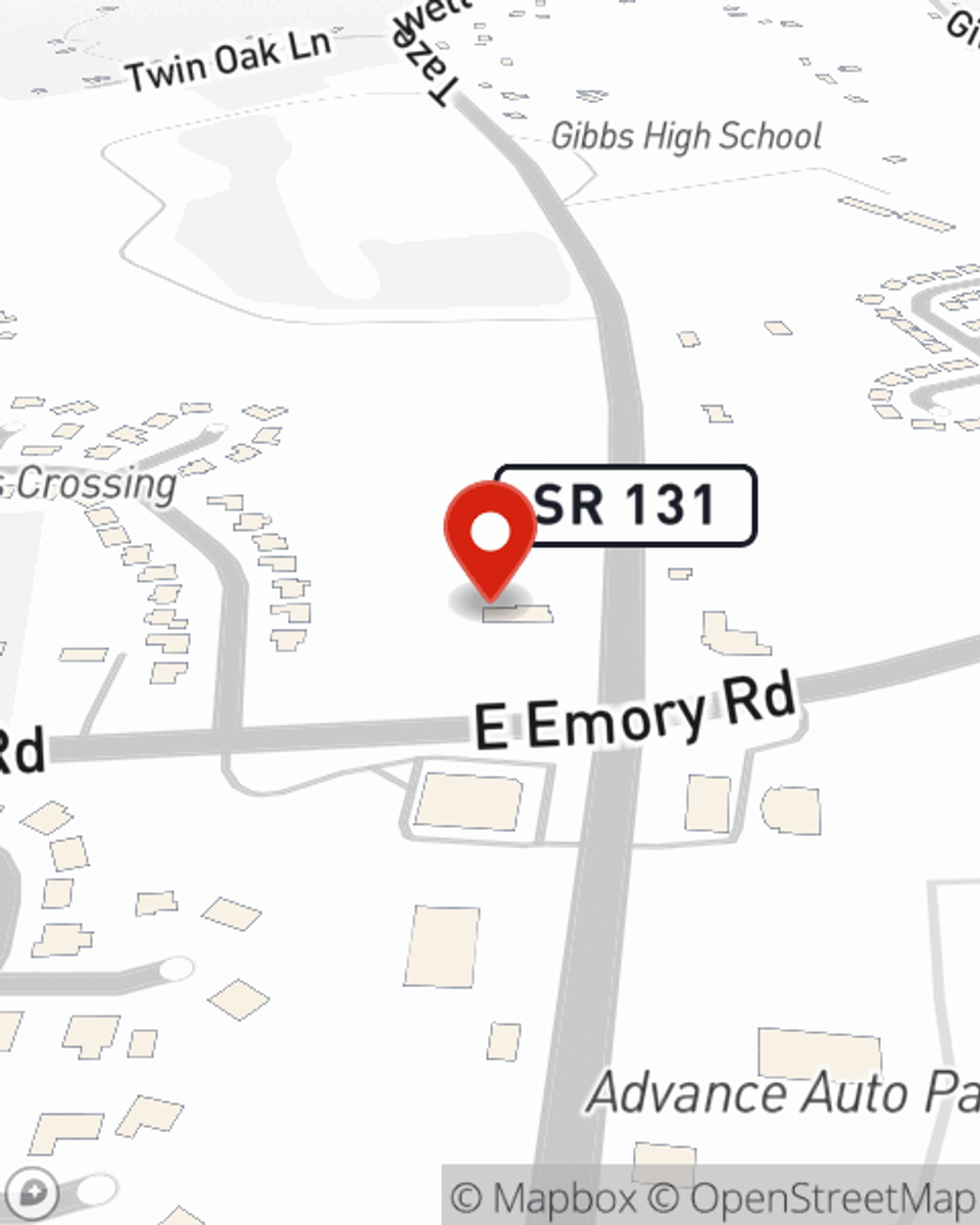

Get in touch with State Farm Agent Devin Masoner today to check out how the trusted name for life insurance can protect your loved ones here in Corryton, TN.

Have More Questions About Life Insurance?

Call Devin at (865) 500-8001 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Devin Masoner

State Farm® Insurance AgentSimple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.